NEW YORK (CNNMoney) -- Nervous investors finally got some good news out of Europe Thursday, which might be enough to allow U.S. stocks to follow European markets higher.

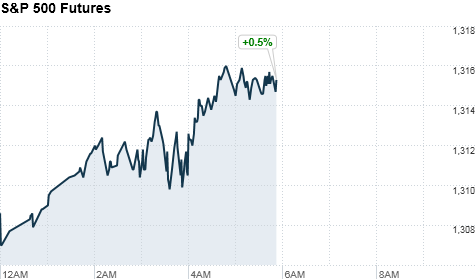

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all up about 0.5% early Thursday morning. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

Germany's May jobs report boosted market optimism, stating that the number of those with jobs remained unchanged, rather than the forecasted loss of jobs. The adjusted unemployment rate fell to a two-decade low of 6.7%.

Later Thursday, voters in Ireland are expected to approve more stringent budget rules in a referendum. The struggling country could lose access to additional bailout funds if voters reject the fiscal treaty, so a positive vote could reassure investors. Markets have been nervous that Greek voters could reject austerity measures and force that country out of the eurozone.

Investors are still worried about Spain not being able to fund bank bailouts that could reach as much as €100 billion. Yields on 10-year Spanish debt soared to 6.6% Wednesday.

Concerns about Europe's debt crisis pushed the yield on the benchmark U.S. 10-year note down to a record low of 1.62% Wednesday, while oil prices fell to a 7-month low. U.S. stocks also fell sharply on Wednesday.

European stocks were all higher in morning trading. Britain's FTSE 100 (UKX) rose 0.8%, the DAX (DAX) in Germany edged up 0.6%, while and France's CAC 40 (CAC40) added 0.7%.

On the domestic front, investors will receive reports on U.S. initial jobless claims, private sector jobs and manufacturing. The government will also release a revised estimate of first-quarter GDP before the opening bell.

The latest batch of jobs reports comes before the government's closely-watched monthly jobs report, which is due Friday. Analysts surveyed by CNNMoney expect that the U.S. economy added 150,000 jobs in May, including 12,000 government cuts. The unemployment rate is expected to stay at 8.1%.

Economy: Initial jobless claims for the week ended May 26 are expected to total 368,000, according to a survey of analysts by Briefing.com, down from 370,000 in the week prior. The private-sector jobs report is expected to show 157,000 jobs added in May, by payroll processor ADP.

The Chicago Purchasing Manager Index, which tracks manufacturing activity in much of the Midwest, is expected to come in at 57.0 for May, up from 56.2 in the month prior. The report is seen an indicator of what will happen with the national reading on manufacturing from the Institute of Supply Management, due on Friday.

First-quarter GDP, scheduled for release at 8:30 a.m. ET, is expected to be revised downward to 2.0% from 2.2%.

Companies: Wells Fargo (WFC, Fortune 500) pledged $432.5 million in new loans and financial assistance to settle a lawsuit, filed by the city of Memphis claiming the bank targeted minorities for predatory lending.

Shares of Facebook (FB) slipped slightly in after hours trading Wednesday after closing out the trading day down 2%.

Shares of TiVo (TIVO) fell 2% in extended trading after the DVR maker reported a larger-than-expected quarterly loss. Lions Gate Entertainment (LGF) fell 7% after the bell, as the film studio reported a net loss for the quarter driven by acquisition costs.

World markets: Asian markets lost ground on Wednesday. The Shanghai Composite (SHCOMP) fell 0.5%, the Hang Seng (HSI) in Hong Kong lost 0.3% and Japan's Nikkei (N225) closed 1.1% lower.

Currencies and commodities: The dollar lost ground against the euro, the British pound and the Japanese yen.

Oil for July delivery rose 38 cents to $88.20 a barrel.

Gold futures for June delivery rose $6.70 to $1,570.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell off Wednesday's record highs, pushing the yield up to 1.64% from 1.62% late Wednesday.

No comments:

Post a Comment