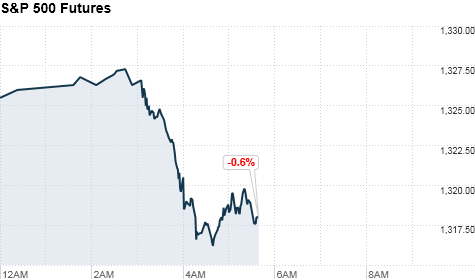

NEW YORK (CNNMoney) -- U.S. stock futures were set for a lower open as investors await U.S. economic reports, and as European leaders meet in a key summit.

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were lower early Thursday morning. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

The U.S. government will release its final estimate of first-quarter GDP growth and weekly data on initial jobless claims ahead of the opening bell.

But investors will spend Thursday watching for news from a summit of European leaders, who are looking for ways out of the continent's debt crisis.

European leaders are under pressure to announce plans at their two-day summit to backstop the debts of struggling nations, while also laying the groundwork for future growth. With so many similar summits having come and gone, however, investors aren't betting on any concrete solutions emerging.

Spain has been of particular concern lately, with its stratospheric borrowing costs threatening to drive it from private markets. Prime Minister Mariano Rajoy told Spain's parliament Wednesday that the country could not continue to finance itself at current rates for much longer.

Italy may be in similar trouble, after Thursday morning's auction for 5- and 10-year bonds pushed yields up to their highest levels since January.

Meanwhile in the U.S., the Supreme Court is also expected to announce its ruling on President Obama's healthcare reform law.

Hospitals such as Community Health Systems (CYH, Fortune 500) and HCA (HCA, Fortune 500), and insurers such as UnitedHealth (UNH, Fortune 500), WellPoint (WLP, Fortune 500) and Humana (HUM, Fortune 500), could have a lot to gain or lose on the decision.

U.S. stocks closed with solid gains Wednesday, following strong reports on durable goods orders and housing.

World markets: European stocks were down in morning trading. Britain's FTSE 100 (UKX) shed 0.9%, while the DAX (DAX) in Germany dropped 1.5% and France's CAC 40 (CAC40) fell 0.8%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) lost 1% and the Hang Seng (HSI) in Hong Kong slid 0.8%, while Japan's Nikkei (N225) gained 1.7%.

Economy: The Labor Department's report on initial jobless claims for the week ended June 23 is due at 8:30 a.m. ET. Claims are expected to total 385,000, according to a survey of analysts by Briefing.com.

The government's final estimate of first-quarter GDP is also due at 8:30 a.m. ET, and is expected to remain unchanged at 1.9%.

Companies: Nike (NKE, Fortune 500) and Research In Motion (RIMM) will report their quarterly earnings after the closing bell.

Nike is expected to post earnings of $1.37 a share on $6.5 billion in revenue. Research In Motion is tipped to report a loss of one cent per share on $3.1 billion in revenue, which would be a 37% drop versus last year.

Shares of JPMorgan Chase (JPM, Fortune 500) fell more than 5% early Thursday morning, after a New York Times report that losses on the bank's erroneous bet on credit derivatives might total $9 billion -- far higher than the $2 billion previously estimated in May.

Currencies and commodities: The dollar rose against the euro and British pound, but fell against the Japanese yen.

Oil for August delivery slid 37 cents to $79.84 a barrel.

Gold futures for August delivery fell $9.50 to $1,568.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.59% from 1.62% late Wednesday.

No comments:

Post a Comment