NEW YORK (CNNMoney) -- Bank shares led a broad sell-off on Wall Street Thursday as a key summit of European leaders got underway.

Stocks pushed deeper into the red as the U.S. Supreme Court announced it was upholding President Obama's healthcare reform law.

Shares of health insurance companies fell sharply, while hospital stocks posted large gains. Insurers UnitedHealth (UNH, Fortune 500), WellPoint (WLP, Fortune 500) and Humana (HUM, Fortune 500) dropped between 2% to 4%. Hospitals, including Community Health Systems (CYH, Fortune 500) and HCA (HCA, Fortune 500) rose between 6% to 7%.

Bank stocks remained under pressure after The New York Times reported that JPMorgan's (JPM, Fortune 500), trading losses at the firm could reach $9 billion. Shares of JPMorgan fell 3%, while Bank of America (BAC, Fortune 500), Morgan Stanley (MS, Fortune 500), and Citigroup (C, Fortune 500) dropped 2% Thursday.

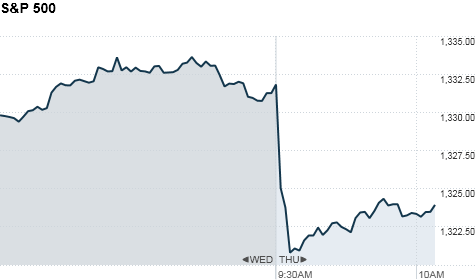

The Dow Jones industrial average (INDU) dropped 155 points, or 1.2%. The S&P 500 (SPX) fell 16 points, or 1.2%. The Nasdaq (COMP) sank 46 points, or 1.6%.

Investors are on edge about Europe, where leaders are faced with the daunting task of coming up with a concrete solution to the continent's debt crisis. But with so many similar summits having come and gone, investors aren't betting on any concrete solutions emerging.

Spain has been of particular concern, with its stratospheric borrowing costs threatening to drive it from private markets.

Italy may be in similar trouble. Borrowing costs have been steadily rising, and while the yield on the 10-year bond hasn't yet reached 7% -- it now hovers above 6.2%. Early Thursday, the government auctioned €5.4 billion for 5- and 10-year bonds pushing yields up slightly.

Gerry Davies, a ForexLive currency analyst in London, said the situation in both countries is adding pressure for Spanish Prime Minister Mariano Rajoy and Italian Prime Minister Mario Monti to leave this week's summit with some resolve.

"Expectations are pretty close to zero of anything meaningful coming from the discussion," Davies said.

Mark Helweg, president of financial technology company MicroQuant, said the court striking down all or some of the law could be welcomed by the market, as symbolic show of restraint on government intervention in the private sector.

U.S. stocks closed with solid gains Wednesday, following strong reports on durable goods orders and housing.

World markets: European stocks were down in afternoon trading. Britain's FTSE 100 (UKX) shed 0.8%, while the DAX (DAX) in Germany dropped 2.1% and France's CAC 40 (CAC40) fell 2%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) lost 1% and the Hang Seng (HSI) in Hong Kong slid 0.8%, while Japan's Nikkei (N225) gained 1.7%.

Economy: On the domestic front, the Labor Department reported Thursday morning that weekly jobless claims dropped 6,000 to 386,000, slightly more than expected. And the final estimate of first-quarter U.S. GDP growth was in line with expectations at 1.9%.

Companies: Shares of News Corp. (NWSA, Fortune 500) dropped after the company's board unanimously approved separating its entertainment side from publishing. Rupert Murdoch will chair both companies.

Family Dollar's (FDO, Fortune 500) stock sank after the operator of discount chains reported earnings and revenue that fell short of expectations, and reaffirmed its guidance.

Nike (NKE, Fortune 500) and Research In Motion (RIMM) will report their quarterly earnings after the closing bell.

Nike is expected to post earnings of $1.37 a share on $6.5 billion in revenue. Research In Motion is expected to report a loss of one cent per share on $3.1 billion in revenue, which would be a 37% drop versus last year.

Currencies and commodities: The dollar rose against the euro and British pound, but fell against the Japanese yen.

Oil for August delivery slid 64 cents to $79.62 a barrel.

Gold futures for August delivery fell $14.10 to $1,564.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.59% from 1.62% late Wednesday.

No comments:

Post a Comment