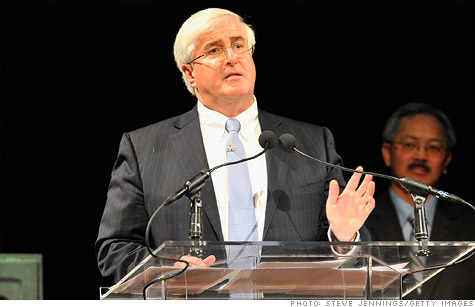

Tech investor Ron Conway says there is more room to grow before the tech bubble even comes close to bursting.

LOS ANGELES (CNNMoney) -- One of the earliest investors in tech darlings Google, Facebook and Twitter says any talk of a tech bubble is overblown.

"We are nowhere near a bubble," says Ron Conway. He most recently invested in Instagram, which Facebook just snapped up for $1 billion.

"The companies getting funded have sales and profits," Conway said Monday, during a panel on Silicon Valley investing at the Milken Institute Global Conference in Los Angeles.

Conway argues that simply looking at e-commerce shows just how much more money can be created through the web.

Currently, fewer than 6% of people buy online. By his estimates, that figure will jump to 25% over the next 10 years. "Investors are understanding what I've been saying since 1994, that we are in the infancy of the Internet," he said.

Still, he acknowledges that valuations have been "sloppy," meaning investors were throwing money at startups without doing enough due diligence.

One of the hottest new areas is collaborative consumption, which includes companies that create a marketplace for people to buy, sell or rent their cars, houses and other possessions.

Conway recently participated in a $111 million funding round for AirBnB, which lets owners rent out their houses. "The Facebook generation doesn't care about owning things," he said. "They don't have a problem with sharing cars and renting rooms in other houses."

And that should be a boon for start-ups.

He estimates that if 1 in 200 companies gets funded now, that could turn into 5 of 200 soon.

While Facebook's upcoming IPO is drawing much attention, Conway sees more room for mergers and acquisitions in the tech field. "IPO is the exception to the rule," he said.

Companies that draw a lot of attention, such as Facebook, will continue scooping up niche firms that vie for consumers' online attention.

For example, Conway touted Pinterest as "the fastest growing company on the web." Pinterest lets consumers collect images from around the web and "pin" them on a personalized board. Coincidentally, Conway is also an investor.

Overall, he says innovation is accelerating so the four horsemen of tech -- Apple (AAPL, Fortune 500), Google (GOOG, Fortune 500), Amazon (AMZN, Fortune 500), and Microsoft (MSFT, Fortune 500) -- have even more to worry about.

Facebook will have the best chance of staying at the forefront because of its business model of what he calls standardized disruption. "For this reason, it will take a longer time before they get disrupted," said Conway.

Still, he said not to count Google out, and while touting Larry Page as a visionary, he added a not-so-veiled swipe at Microsoft. "People who put Google and Microsoft in the same sentence are very very foolish."

No comments:

Post a Comment