NEW YORK (CNNMoney) -- U.S. stocks were modestly higher Friday, the final trading day of a strong quarter, as investors weighed mixed economic reports and a boost in the eurozone bailout fund.

While worries about a growth slowdown have kept investors sidelined lately, it's been a stellar three months for stocks, with all three major U.S. indexes on track to log solid gains. The Dow is up almost 8%, the S&P 500 is up nearly 12% and the Nasdaq has gained a whopping 19% since New Year's Day.

Each index is within striking distance of milestone levels. The Nasdaq logged its best close since 2000 earlier this week and remains near that mark. In addition, the S&P 500 and Dow are close to setting fresh multi-year highs.

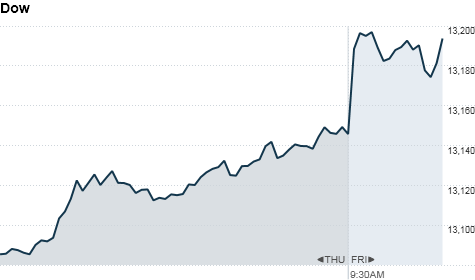

Early Friday, the Dow Jones industrial average (INDU) gained 37 points, or 0.3%, S&P 500 (SPX) added 4 points, or 0.3% and Nasdaq (COMP) rose 2 points, or 0.1%.

The week has been filled with a string of lackluster numbers on durable goods, home prices and the labor market. Ongoing concerns about a growth slowdown in China have added pressure to world markets.

The highest earning hedge fund manager is ...

U.S. stocks bounced around Thursday before ending little changed. Both the S&P 500 and the Nasdaq closed in the red for the third straight day, while the Dow broke a two-day losing streak.

Economy: A report released before the opening bell showed that personal spending increased 0.8% in February, topping analyst predictions of a 0.6% jump.

Meanwhile, personal income grew by 0.2%, less than the 0.3% predicted rate.

The Chicago Purchasing Managers' Index for March fell to 62.2, down from 64 in February and below expectations to come in at 63. Any reading above 50 indicates expansion.

The March edition of the University of Michigan Consumer Sentiment Index rose to 76.2, from 74.3 in February. Analysts were expecting the index to remain flat.

Companies: Shares of Apple (AAPL, Fortune 500) were slightly lower a day after a heavily anticipated report on working conditions at supplier Foxconn's China facilities was released. The report documents dozens of major labor-rights violations, including excessive overtime, unpaid wages and salaries that aren't enough to cover basic living expenses.

On Friday, retailer Finish Line (FINL) said it earned 81 cents per share last quarter -- a number in line with analyst estimates. The company reported better-than-expected revenue, but shares tumbled.

Research in Motion (RIMM) shares were higher even after the BlackBerry-maker missed expectations on revenues and earnings. The company said it's considering strategic alternatives, and one director left its board.

World markets: European stocks were higher in afternoon trading. Britain's FTSE 100 (UKX) increased 0.6%, the DAX (DAX) in Germany rose 0.7% and France's CAC 40 (CAC40) jumped 1.3%.

Eurozone finance ministers agreed to increase the size of the region's capacity for crisis lending to €700 billion.

Like a bear in a China shop

Asian markets ended mixed. The Shanghai Composite (SHCOMP) added 0.5%, while the Hang Seng (HSI) in Hong Kong and Japan's Nikkei (N225) dropped 0.3%.

Currencies and commodities: The dollar lost ground against the euro, the British pound and the Japanese yen.

Oil for May delivery added 12 cents to $102.90 a barrel.

Gold futures for April delivery rose $8.10 to $1,661.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.17% from 2.16% late Thursday.

No comments:

Post a Comment